Recovery rebate credit 2020 calculator

All Prior Year Software. 2021 Recovery Rebate Credit.

Recover Rebate Credit

You can find AGI on line 11 of your 2020 federal 1040 income tax return or line 8b of your 2019 return.

. Slow hot water recovery time it takes longer to heat up water. Print Prior Year Return. This credit is figured like last years economic impact payment EIP 3 except eligibility and the amount of the credit are based on your tax year 2021 information.

The notice even confirms my AGI as. You can contact HMRC about the Coronavirus Statutory Sick Pay Rebate Scheme if you cannot get the help you need online. Thats the money youre rightfully owed from any of the three stimulus payments.

In 2022 President Bidens Build Back Better infrastructure bill intended to increase the electric car tax credit from 7500 to 12500 for qualifying vehicles but this bill failed. The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021. Claim your 7500 credit if you purchased a new electric vehicle EV in 2022.

File 2017 Tax Return. Only one rebate per home for a primary space heating system and a water heater is allowed. If you werent able to claim your earlier 1200 or 600 stimulus checks you can do so on your 2020 tax returns.

How to Claim 2020 Recovery Rebate Credit. Americans with very low 2020 AGI or Adjusted Gross income are encouraged to file a 2020 tax return to also take advantage. 2021 GVSDD Metro Vancouver Amending Agreements to the Biomethane Purchase Agreement.

Eligible individuals who filed a 2019 joint tax return will receive up to 1200 and all other eligible individuals will receive up to 600Those with qualifying children on their 2019 tax return will receive up to 600 in additional payment per qualifying child. See Revenue Procedure 2020-45 at IRSgovRP2020-45. Instead you will have to file a 2020 tax return to the claim the payment as the Recovery Rebate Credit.

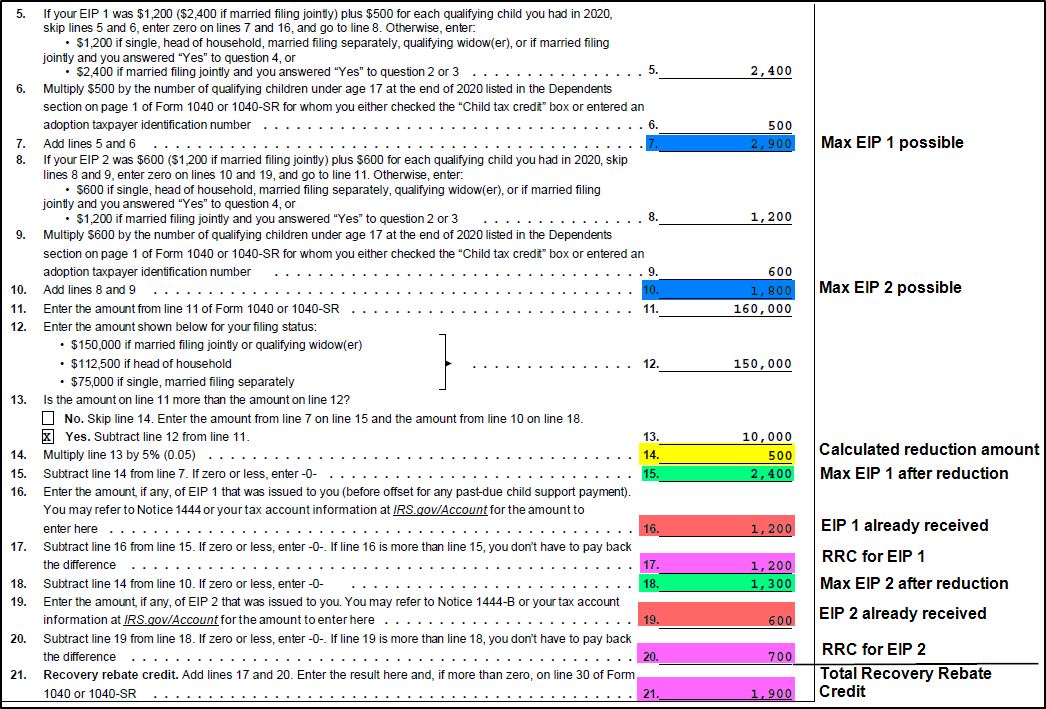

Any economic impact payments you received are not taxable for federal income tax purposes but they reduce your recovery rebate credit. Stimulus payments are no longer being issued but the information below is how the Recovery Rebate Credit is calculated. Second Stimulus Check Calculator.

You had compensation of 10 from this transaction. If you file annual GSTHST returns use the 1 credit on your first 30000 of revenue from your eligible supplies in that fiscal year. The payment amount is reduced by 5 of the.

File 2020 Tax Return. Fill in the step-by-step questions and your tax return is calculated. 2020 Biomethane Energy Recovery Charge BERC Rate Methodology G-133-16 Assessment Report.

File 2018 Tax Return. Shelly a 2020 college graduate didnt receive any stimulus in the first round because she was claimed as a dependent on her parents 2019 return. The IRS has created a page on IRSgov that includes information about Pub.

The reason this return is important is that it provides a way for you to claim your Recovery Rebate Credit. By Alana Benson Sabrina Parys Tina Orem. The federal Residential Energy Efficient Property Credit income tax credit on IRS Form 5695 for residential PV and solar thermal was extended in December 2015 to remain at 30 of system cost parts and installation for systems put into service by the end of 2019 then 26 until the end of 2020 and then 22 until the end of 2021.

If your 20 Tax Return Filing Status wasis Single and your AGI or Adjusted Gross Income was below 75000. I tried to call the IRS 800 number several times but due to call volume. The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit.

Offer valid for returns filed 512020 - 5. According to the information that the IRS provides you only need to file your 2020 tax return which is the return for last year. Because of the changes made by the.

To make a claim for the alternative fuel mixture credit for 2018 or 2019 you must file Form 720-X Amended Quarterly Federal Excise Tax Return. The credit for other dependents has not been enhanced and is figured as it was in 2020. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Best Tax Software for 2022. See how the recovery rebate credit works Scenario 1 Recovery Rebate Credit and first-time filers. How do I claim my stimulus checks as the Recovery Rebate Credit on my tax return.

In 2020 you sold the stock to your spouse for 10 in a transaction not at arms length. Sales of electric vehicles continues to grow through 2022 and 2023 as more options are given to consumers. My Adjusted Gross Income AGI was below 150K married filed jointly and still received an IRA Notice CP11 saying that I owe the RRC back 1400.

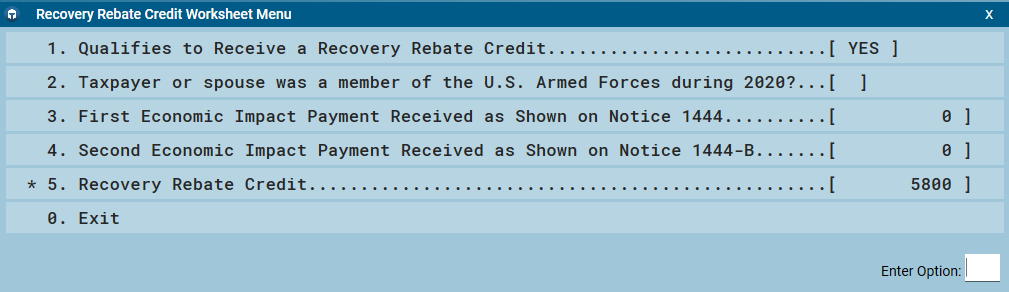

CARES Act Prison Case has IRS instructions on how people who are incarcerated can file a 2020 tax return a blank IRS 2020 tax form you can print and fill out and a completed IRS sample 2020 tax form you can referenceYou will need to file a 2020 tax return to get the first and second. Then you will claim a Recovery Rebate Credit on your 2020 tax return. Use the Recovery Rebate Credit Worksheet and enter the amount from the worksheet onto Line 30 of your 1040.

However she is no longer a student and doesnt qualify as her parents dependent for 2020. Published 3 April 2020 Last updated 1 April 2022 show all updates. More information about the Second Economic Impact Stimulus Payment.

If you dont receive a second stimulus check by then you can claim it as a recovery rebate credit on your 2020 federal income tax return. In 2021 when the. If your second stimulus check didnt reflect all of your qualifying dependents or if your income decreased in 2020 and you only received a partial stimulus check based on your 2019 income you can claim the additional money when you file a.

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. This is line 30 of your. File 2019 Tax Return.

Best online tax calculator. Other loan forgiveness under the CARES Act. 2020 Actuarial Value Calculator VNDMS-EXCELSHEETMACROENABLED12.

Dive even deeper in Taxes. As was the case in 2020. However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Estimate your 2021 taxes. 2021-2022 Capital Gains Tax Rates and Calculator. The credit is available to those who did not receive the Economic Impact Payments or who received less than the full amount that they were eligible for.

If you file monthly or quarterly GSTHST returns the 1 credit applies to the first and the following reporting periods of a fiscal year until you reach the 30000 threshold or the fiscal year ends. 2020 Tax Returns can no longer be e-filed. The payments will be based on 2020 AGI if a taxpayer has already filed tax returns for last year.

September 30 2020 Treatment of Risk Corridors Recovery Payments in the Medical Loss Ratio MLR and Rebate Calculations PDF December 30 2020 Treatment of Risk Corridors Recovery Payments in the Medical Loss Ratio MLR and Rebate Calculations - Final PDF. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. To claim a missing stimulus payment for stimulus 1 or 2 or the 2020 Recovery Rebate Credit file 2020 Taxes and include this on Line 30 of the Form 1040.

Use the link to prepare.

Ready To Use Recovery Rebate Credit 2021 Worksheet Msofficegeek

Recovery Rebate Credit Worksheet Explained Support

Recovery Rebate Credit 2021 Tax Return

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

Missed Stimulus Check Deadline Don T Worry You Can Still Claim It As A Credit Here Is How Internal Revenue Code Simplified

Recovery Rebate Credit H R Block

Recovery Rebate Credit How Much Can I Claim For 2021 Melton Melton

2020 Recovery Rebate Credit Topic G Correcting Issues After The 2020 Tax Return Is Filed Nstp

Recovery Rebate Credit 2021 2022 Credits Zrivo

Expect Refund Delays If You Claimed The Recovery Rebate Credit On Your 2020 Tax Return Donovan

Recovery Rebate Credit On Amended Return

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Explained Support

Irs Cp 12r Recovery Rebate Credit Overpayment

Desktop 2020 Recovery Rebate Credit Support

How Can I Claim The Additional Stimulus Money For My Qualifying Dependent S If I Never Received It Support

Irs Cp 11r Recovery Rebate Credit Balance Due